Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Remember the good old days when “sharing” meant letting your brother borrow your lawnmower or giving your neighbor a cup of sugar? It was simple. You handed over the item, they said thanks, and eventually, you got your lawnmower back (usually with an empty gas tank, but still).

Fast forward to today, and “sharing” involves invisible digital clouds, family plans, and passwords that require a master’s degree in cryptography to remember. You decide to be the benevolent patriarch or matriarch and sign up for the “Family Plan” on Netflix or Spotify. It seems like a great deal—one low price for everyone!

But then reality sets in. You’re paying the bill every month, but your nephew in college is the only one using the premium 4K screen allowance. Or worse, you try to watch a movie on Saturday night, only to be told you can’t because too many people are streaming. You are digitally locked out of the house you are paying the mortgage on.

If this sounds familiar, welcome to the brave new world of Digital Account Stewardship. It’s where love meets logistics, and where “family sharing” can quickly turn into “family feuding.” Today, we’re going to untangle the financial and practical knots of shared subscriptions so you can get back to enjoying your technology—without being the family ATM.

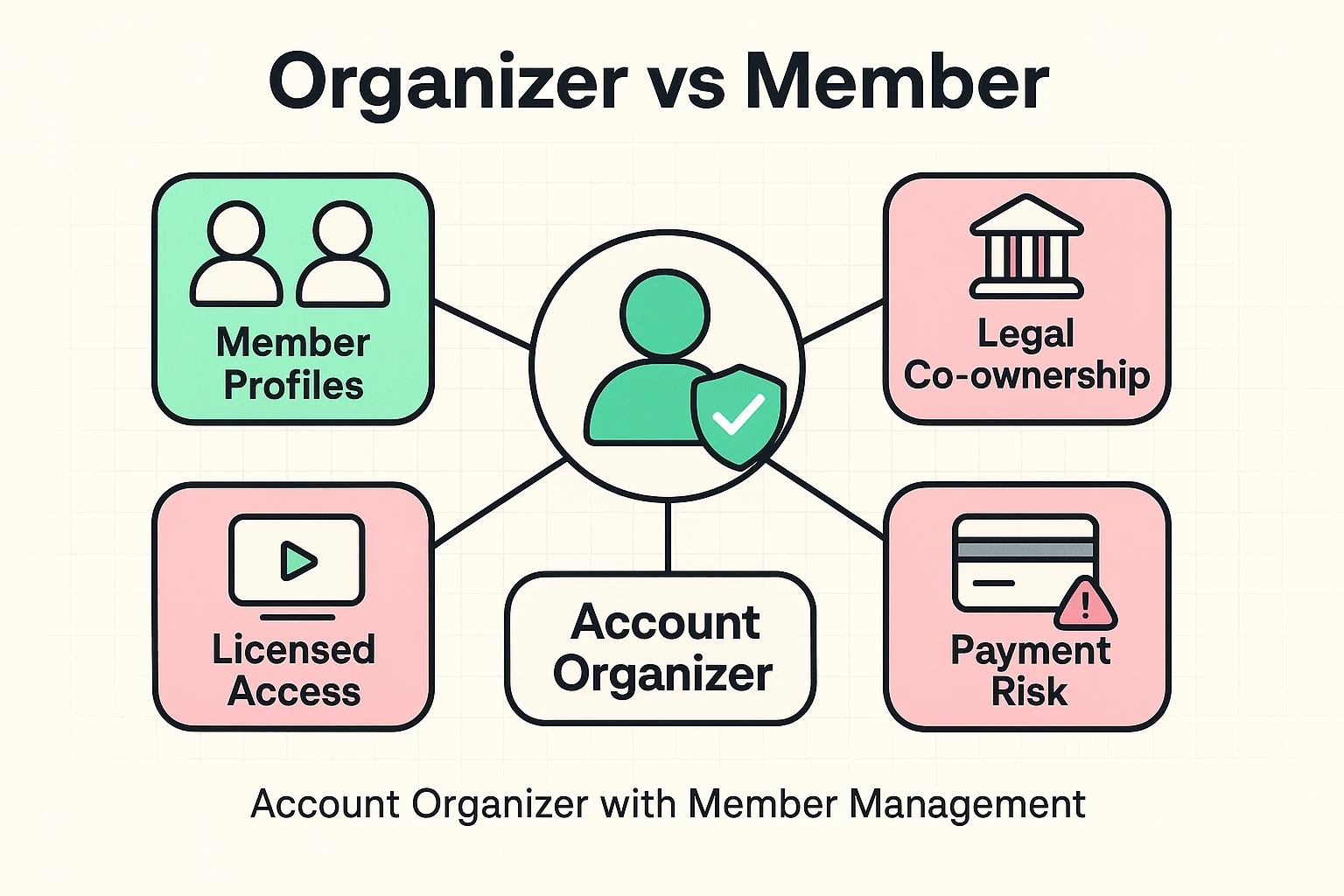

The biggest misconception about family plans is that they are democracies. They aren’t. In the eyes of Big Tech companies, they are dictatorships, and if you signed up, you are the dictator (or, more politely, the Organizer).

When you open a joint bank account with your spouse, you are usually legally co-owners. The bank views you as equals. If the account is overdrawn, you are both responsible.

Streaming services and app subscriptions work differently. They operate on a “Patron-Recipient” dynamic. The Organizer is the legal customer. You own the debt, the credit score risk, and the administrative headache. Everyone else? They are just guests at your party.

This creates a hidden power imbalance. If a “member” decides to buy a fancy movie rental or upgrade an app feature, guess whose credit card gets charged? Yours. And if they don’t pay you back, Netflix doesn’t care. They just want their money.

It is vital to understand the difference between a “Joint Account” and a “Shared Subscription.”

In a Joint Bank Account, both parties have a legal right to the funds. If you put money in, the other person can legally take it out. It requires a high level of trust, usually reserved for spouses or power-of-attorney situations.

In a Shared Digital Subscription (like Amazon Prime or Apple Family Sharing), you are granting Licensed Access. You are effectively loaning out a key to your house. You can change the locks (passwords) at any time.

The friction starts when we treat digital subscriptions like joint accounts. We assume everyone will “just do the right thing” and chip in. But without clear rules, the Organizer often ends up silently resenting the “freeloaders,” while the members remain blissfully unaware that they owe a dime.

So, how do we split the bill without making Thanksgiving dinner awkward?

The old method was the “Dad pays for everything” model. While generous, this often leads to subscription creep, where you are suddenly paying $200 a month for services you don’t use.

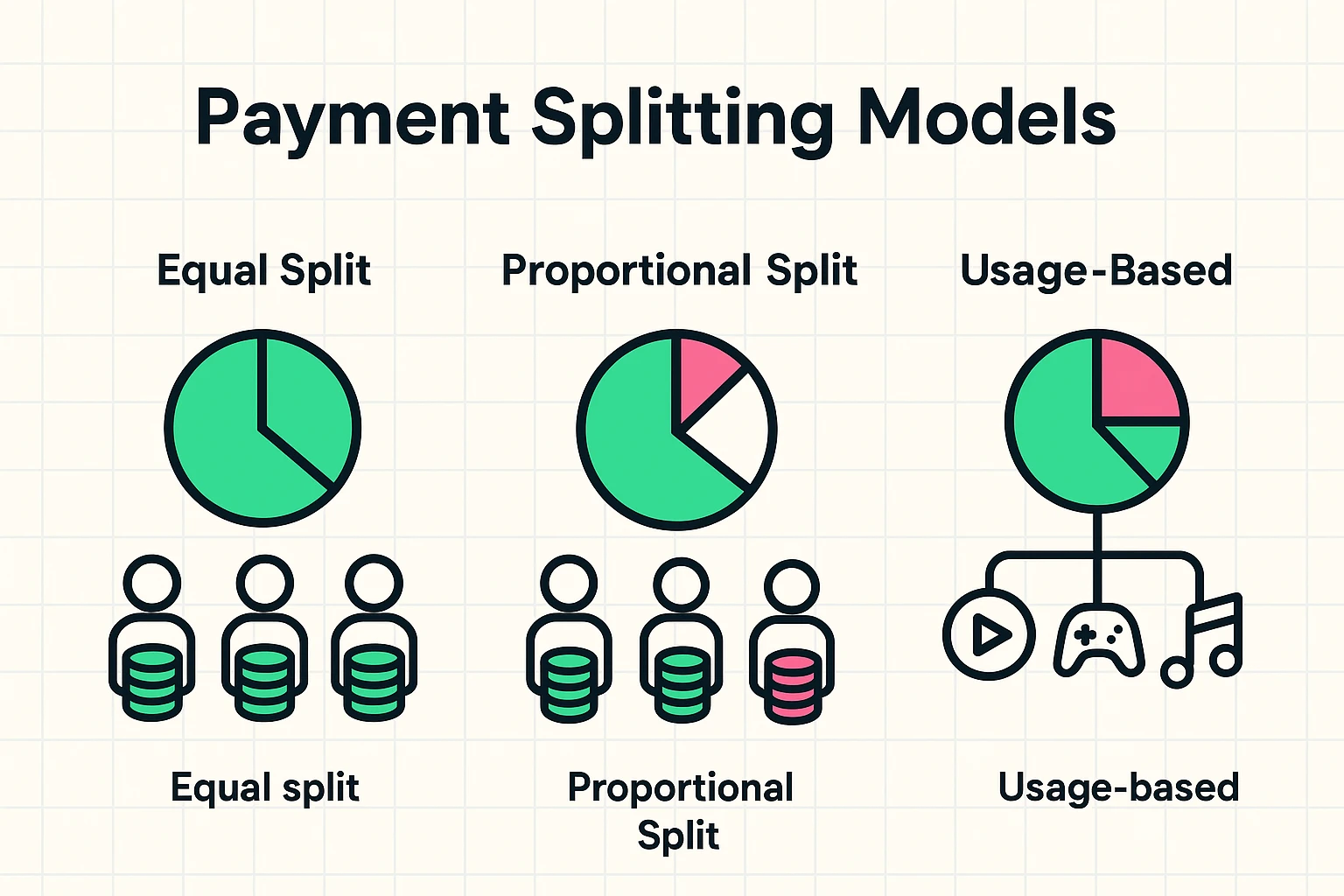

Financial experts and relationship counselors suggest moving toward a “Shared Pot” mentality with clear rules. Here are three models to consider for your family:

Everyone pays the same amount, regardless of how much they use it. If the bill is $20, and there are four people, everyone owes $5.

You pay for what you use. If you are the only one using the premium sports package, you pay that portion of the bill.

This is often the best for families with varying incomes (e.g., parents vs. college students vs. adult children). People contribute based on their ability to pay. Perhaps you pay 50%, and your working adult children split the other 50%.

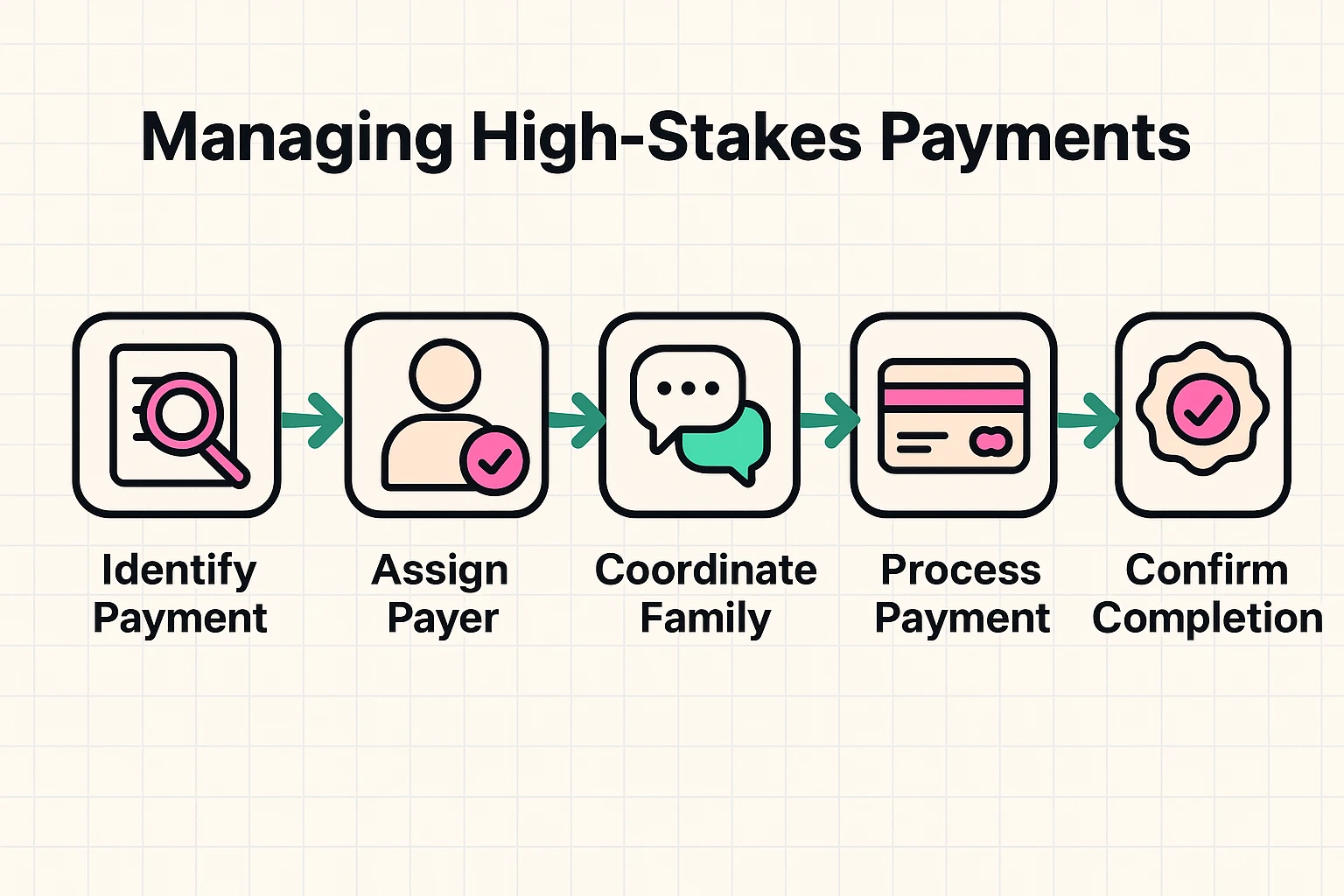

Sharing a password for a movie is one thing. But what happens when the stakes are higher? We are seeing more families encounter friction with “high-stakes” sharing, such as college applications or legal co-parenting expenses.

Take the Common App, for example. This is the platform students use to apply to multiple colleges. It involves application fees that can add up to hundreds of dollars.

Here, the “Organizer” (Parent) and the “Member” (Student) need tight coordination. Deadlines are strict. If the student hits “submit” but the parent hasn’t authorized the payment method, the application doesn’t go through.

This is a great training ground for financial responsibility. Instead of just paying the fee silently, sit down with the student. Show them the cost. Discuss if they are eligible for fee waivers (like those from NACAC). Make the payment process a shared responsibility, even if the money comes from your account.

You don’t need a lawyer, but you do need an agreement. We recommend creating a “Family Digital Constitution.” It sounds fancy, but it’s really just a simple set of rules sent via email or text to everyone on your plan.

Here are a few clauses to include:

Yes. As the account holder, you have the right to manage access. It might make Christmas dinner awkward, but it is not illegal. In fact, many streaming services are now cracking down on password sharing outside the household, so you might be forced to kick them off anyway!

Yes. Apps like Splitwise are great for tracking ongoing expenses. You enter the bill, select who splits it, and it keeps a running tally. It removes the emotion from asking for $14.

For divorced or separated parents, casual texting about money can be stressful. specialized apps like SupportPay or OurFamilyWizard allow you to upload receipts (like that iPad subscription or school software fee) and track payments formally, keeping everything transparent and documented.

In ecosystems like Apple, usually, the Organizer’s credit card is the only payment method allowed for everyone’s purchases to ensure control. If your card expires or hits a limit, everyone’s apps stop working. Keep that card updated!

Technology is supposed to make our lives easier, not make us fight over $9.99 a month. By establishing clear roles, choosing a fair payment model, and communicating openly, you can turn your “Family Plan” back into something that actually benefits the family.

Remember, boundaries are healthy. It is perfectly okay to be generous, but it is also okay to expect fairness. After all, you’re the one keeping the digital lights on.