Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Have you ever gotten a financial tip that sounded so good, you could almost hear a choir of angels singing?

Maybe it was a post from a distant cousin on Facebook, who suddenly looks 20 years younger and is standing next to a Lamborghini, raving about a “guaranteed” crypto investment.

He promises returns so high, you’ll be able to buy your own island and name it after your cat.

Back in the day, the worst financial advice you could get was from your brother-in-law, Gary, after he’d had one too many eggnogs at the holiday party.

Gary’s hot stock tip usually involved a company that made novelty toupees for pets. The risk was low because, let’s be honest, you weren’t actually going to invest.

But today’s bad advice is a different beast entirely. It’s slick, it’s personal, and it’s powered by Artificial IntelligenceArtificial Intelligence (AI) is basically when computers get smart—really smart. Imagine if your c... More (AI). Scammers are using AI to create incredibly convincing traps, from fake investment gurus to cloned voices of your loved ones in distress.

They’ve traded Gary’s questionable toupee company for a high-tech illusion designed to separate you from your savings.

Don’t worry. You don’t need a degree in computer science to stay safe.

We’re going to pull back the curtain on these digital shenanigans, show you how to spot the fakes, and give you the tools to keep your money right where it belongs: in your pocket.

Before we dive into the scams, let’s clear something up. When you hear “AI,” you might picture a talking car or a robot that’s secretly plotting to take over the world. In reality, most AI is less “evil genius” and more “overachieving intern.”

Think of AI as a computer program that can learn and create things on its own. It can write an email, create a picture, or even mimic a person’s voice by studying thousands of examples.

It’s the reason your phone can finish your sentences and why you see ads for garden gnomes five minutes after you mentioned them to your spouse.

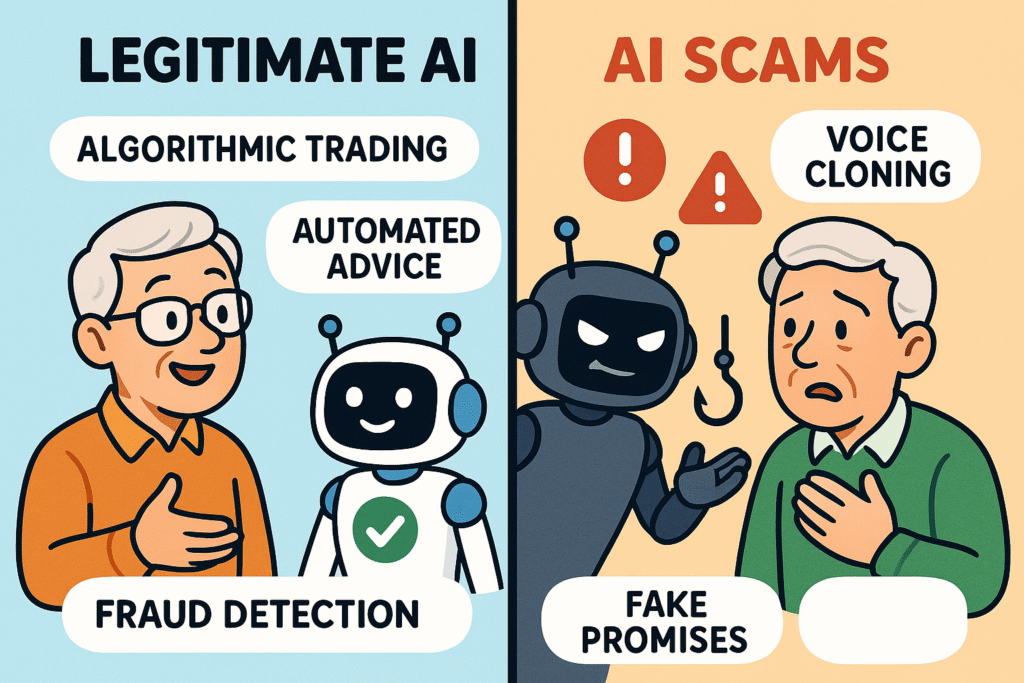

When it comes to your money, AI is a double-edged sword. There are legitimate financial companies that use AI to help manage investments or detect fraud. But scammers use it to build their traps.

The key difference is transparency and promises. Real financial AI is a tool; it doesn’t promise guaranteed riches overnight.

Scammer AI, on the other hand, always comes with a story that’s too good to be true.

And as we all know, if it sounds too good to be true, it’s probably time to go water your plants and think it over.

So, how exactly are these digital pickpockets using AI?

They have a few favorite tools they use to make their scams believable. Once you know what to look for, they become much less convincing.

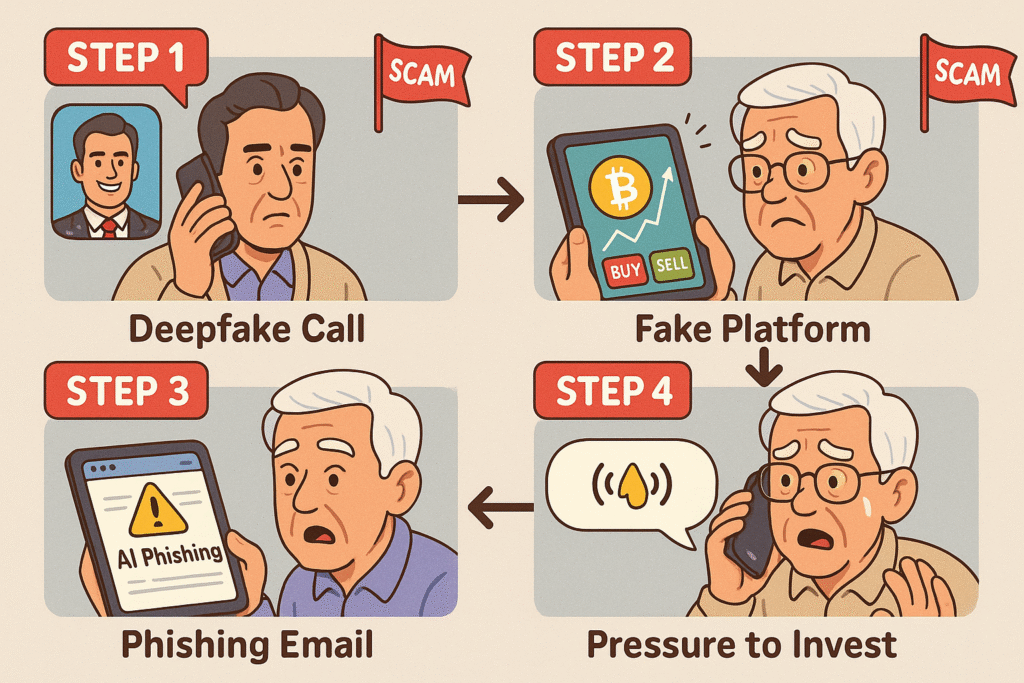

This flowchart breaks down the complex AI crypto scam process into simple, digestible steps, empowering seniors to recognize each tactic used by fraudsters.

This is the scariest one. A “deepfake” is a video or image that has been altered to make it look like someone is saying or doing something they never did.

Voice cloning is the audio version, where a scammer can use a small sample of someone’s voice—maybe from a video you posted online—to create a realistic fake.

Red Flags:

Remember those old scam emails filled with typos? AI has fixed that.

Scammers now use AI to write perfectly crafted emails, social media messages, and even entire websites that look incredibly professional. They can even personalize them with details they find about you online.

Red Flags:

Bank0fAmerica.com (with a zero instead of an ‘o’) or a long, jumbled address. When in doubt, type the website address yourself instead of clicking a link.Some scammers create “chatbots”—automated computer programs—that pretend to be friendly financial advisors or successful investors. They’ll engage you in conversation, build your trust, and then start pushing a crypto or investment scheme.

Red Flags:

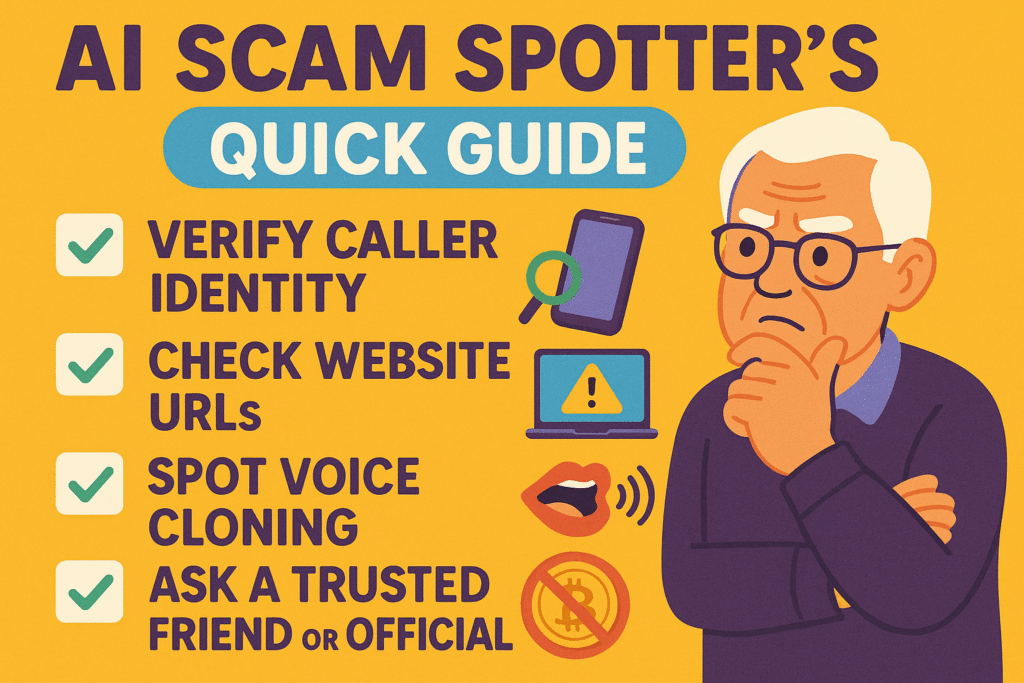

Feeling a little overwhelmed? Don’t be. Protecting yourself comes down to a few simple, powerful habits. Think of this as your cheat sheet for sniffing out digital rats.

This quick reference checklist helps seniors memorize essential steps to spot and avoid AI-powered investment and crypto scams, providing immediate, actionable guidance.

Not at all! Many reputable financial firms use AI for things like managing portfolios (often called “robo-advisors”) or analyzing market trends. The difference is that legitimate companies are transparent, registered, and will never promise you guaranteed, sky-high returns.

First, don’t be embarrassed. These scams are designed to fool anyone. Immediately contact your bank or financial institution to report the fraud and see if any transactions can be stopped. Then, report the scam to the Federal Trade Commission (FTC) at ReportFraud.ftc.gov and the FBI’s Internet Crime Complaint Center (IC3).

Cryptocurrency transactions are largely anonymous and irreversible. Once you send a scammer crypto, there is no central bank you can call to get it back. This makes it the perfect payment method for criminals.

Scammers only need a few seconds of audio to create a voice clone. They can get this from a voicemail message, a social media video, or anywhere else a person’s voice is recorded. That’s why the “verify, then trust” rule is so important.

Navigating the digital world can feel like walking through a minefield sometimes, but you are not powerless. The flashy tools used by scammers—AI, deepfakesDeepfake technology uses advanced artificial intelligence to swap one person’s face onto another i... More, crypto—are just new packaging on an old product: the get-rich-quick scheme.

By staying calm, asking questions, and remembering that no investment is ever “guaranteed,” you can spot these traps from a mile away. The next time you see a post about an AI-powered money-making machine, you’ll know exactly what to do: scroll right on by, and maybe give your real grandson a call, just to chat.

To further protect all your online accounts, consider learning why you need 2-Factor Authentication (2FA)—it’s one of the best ways to keep scammers out.