Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

You’re finally doing it. You’ve found the perfect, high-end, ergonomically-designed bird feeder online. It’s squirrel-proof, endorsed by ornithologists, and it’s on sale. Score!!

You triumphantly enter your credit card number, click “Buy Now,” and lean back, imagining the joyous chirps of well-fed finches.

Suddenly, your phone buzzes with the urgency of a national emergency. It’s a text from your bank: “Did you just spend $4,321 on a shipment of industrial-grade unicycles in Belgium?”

You stare at your phone, then back at the bird feeder confirmation page. Unicycles? Belgium?

This feels less like a simple purchase and more like the opening scene of an international spy thriller you accidentally wandered into.

If this kind of digital head-scratcher sounds familiar, you’re not alone. These alerts can be jarring, but they’re actually a sign that your bank has a new high-tech detective on your case: Artificial Intelligence (AI) for shopping and fraud detection.

Let’s be honest, the term “Artificial Intelligence” sounds like something from a science fiction movie, probably involving robots that decide humanity has outstayed its welcome. In reality, your bank’s AIArtificial Intelligence (AI) is basically when computers get smart—really smart. Imagine if your c... More is less “evil robot” and more “über-diligent bookkeeper who never sleeps.”

Think of it this way: your bank processes millions, if not billions, of transactions every single day. A team of humans couldn’t possibly watch every single one for funny business. It would be like trying to find one specific raindrop in a hurricane.

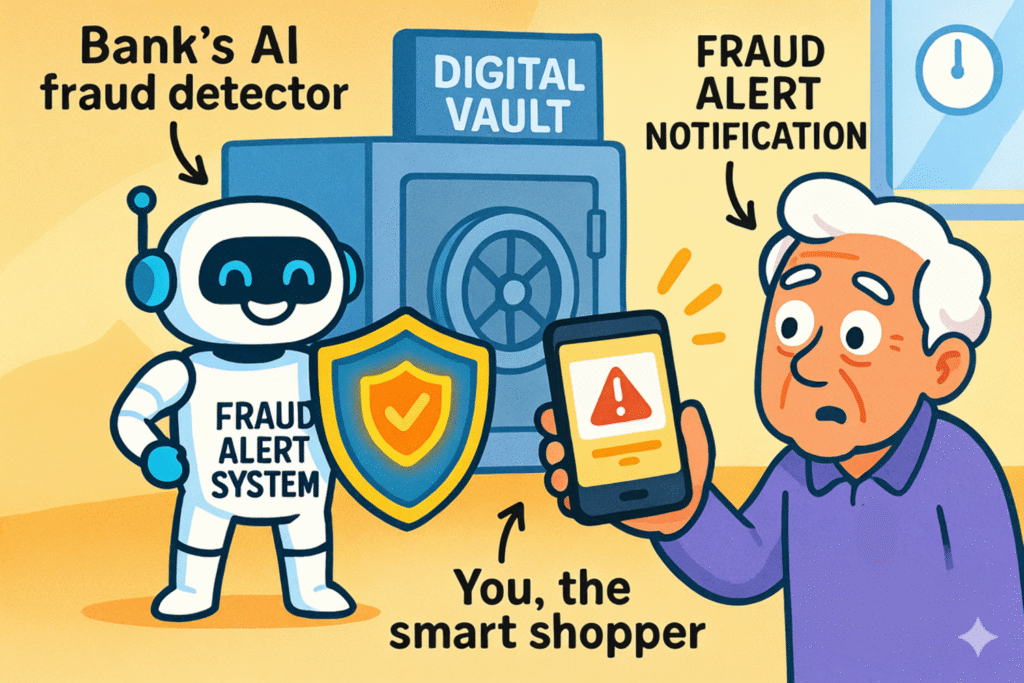

This is where AI steps in. It’s a sophisticated computer program that acts as a digital guard dog for your account. It learns your financial habits—the “normal” rhythm of your spending—so it can instantly spot something that’s out of tune. And with financial fraud losses hitting a staggering $8.8 billion in 2022, having this digital watchdog is more important than ever.

This illustration makes the concept of AI-driven fraud detection tangible by showing the bank’s AI working like a friendly guard to protect your money and alert you about suspicious online transactions.

This technology is especially crucial for older adults. Sadly, scammers often target seniors, with adults over 60 reporting losses of $1.6 billion to fraud in 2022 alone. These AI alerts are one of your best lines of defense, a 24/7 security guard that comes free with your bank account.

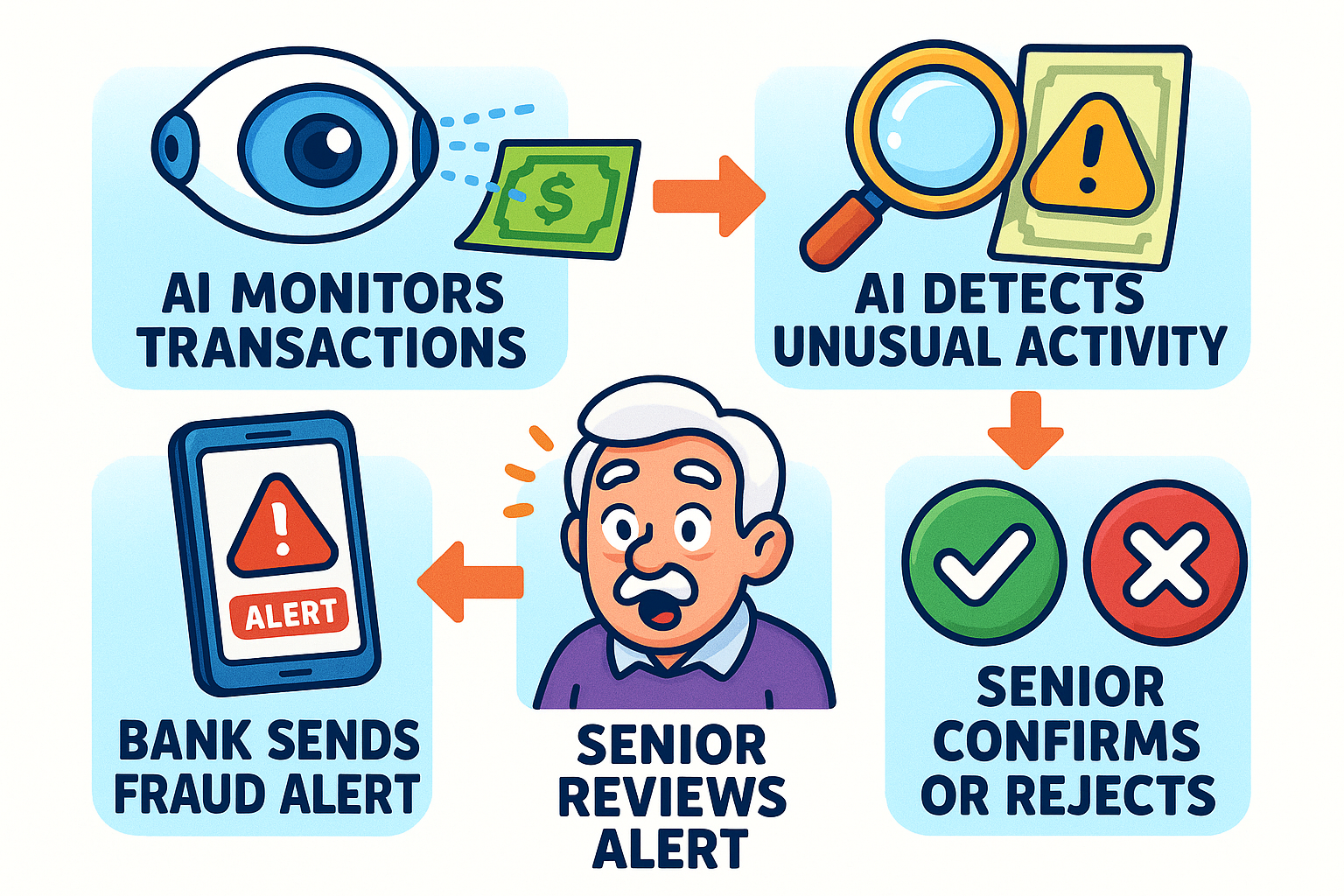

So how does this AI wizardry actually work? It’s not magic, but it’s pretty clever. The process is a bit like a home security system that knows your daily routine.

This flowchart breaks down the fraud detection and alert process into simple steps, helping you understand what happens behind the scenes when their bank suspects online fraud.

Getting a fraud alert can make your heart skip a beat, but knowing how to respond is simple. The key is to stay calm and verify things the right way.

This is the most common type of alert. It will usually mention the purchase amount and the merchant and ask for a simple “YES” or “NO” reply.

Similar to a text, an email alert will detail a suspicious transaction and ask you to confirm it.

Sometimes, for a very large or unusual transaction, a bank’s fraud department might call you directly.

It might feel that way, but no. The AI isn’t judging you for buying another bird feeder. It’s an impersonal system that only looks for mathematical patterns that deviate from your norm. It cares about the “where, when, and how much,” not the “what.”

This is called a “false positive.” It can happen if you’re traveling, making a much larger purchase than usual, or shopping at a new online store. While it can be a minor annoyance, it’s a sign the system is working. A sensitive alarm is much better than one that never goes off.

Don’t panic! Call the fraud department number on the back of your card immediately. The sooner you report the mistake, the faster they can act to reverse the charge and secure your account.

Most banks allow you to customize or turn off alerts, but we strongly advise against it. These alerts are one of the most powerful and immediate tools you have to stop fraud in its tracks. A five-second text reply is a tiny price to pay for peace of mind and financial security, especially when you consider adding another layer like setting up two-factor authentication for your accounts.

Think of these AI fraud alerts not as a hassle, but as a helpful partner. Your bank’s digital detective is always on duty, tirelessly watching your back so you can shop online with confidence.

By understanding what these alerts mean and how to respond safely, you turn a potentially scary moment into an empowering one. You’re not just a customer; you’re the final line of defense, working with your bank’s smart technology to keep your hard-earned money exactly where it belongs: in your account.

Now go on and enjoy that squirrel-proof bird feeder—you’ve earned it!