Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

You know the feeling. You’re sitting there, enjoying a perfectly good cup of coffee and reviewing your credit card statement, feeling like a responsible adult. Then you see it.

That streamingStreaming refers to the process of transmitting or receiving multimedia content, such as audio, vide... More service you signed up for in 2019 to watch exactly one documentary about penguins is no longer $9.99. It is now $14.99. Or maybe $17.99. You squint at the number, hoping it’s a typo. You clean your glasses. Nope. The price has gone up, silently and stealthily, like a ninja raiding your refrigerator in the middle of the night.

It feels like a personal betrayal, doesn’t it? It’s as if you went to the grocery store to buy a loaf of bread for two dollars, and when you got to the register, the cashier smiled and said, “Surprise! Today, bread costs your firstborn child and a 1998 Buick LeSabre.”

If this sounds familiar, you are not alone. This is the era of the “Subscription Creep.” Companies are betting that you are too busy, too polite, or simply too baffled by the “Cancel” button to do anything about it. They are banking on what economists might call “consumer inertia,” but what we call “I’d rather have a root canal than call customer service.”

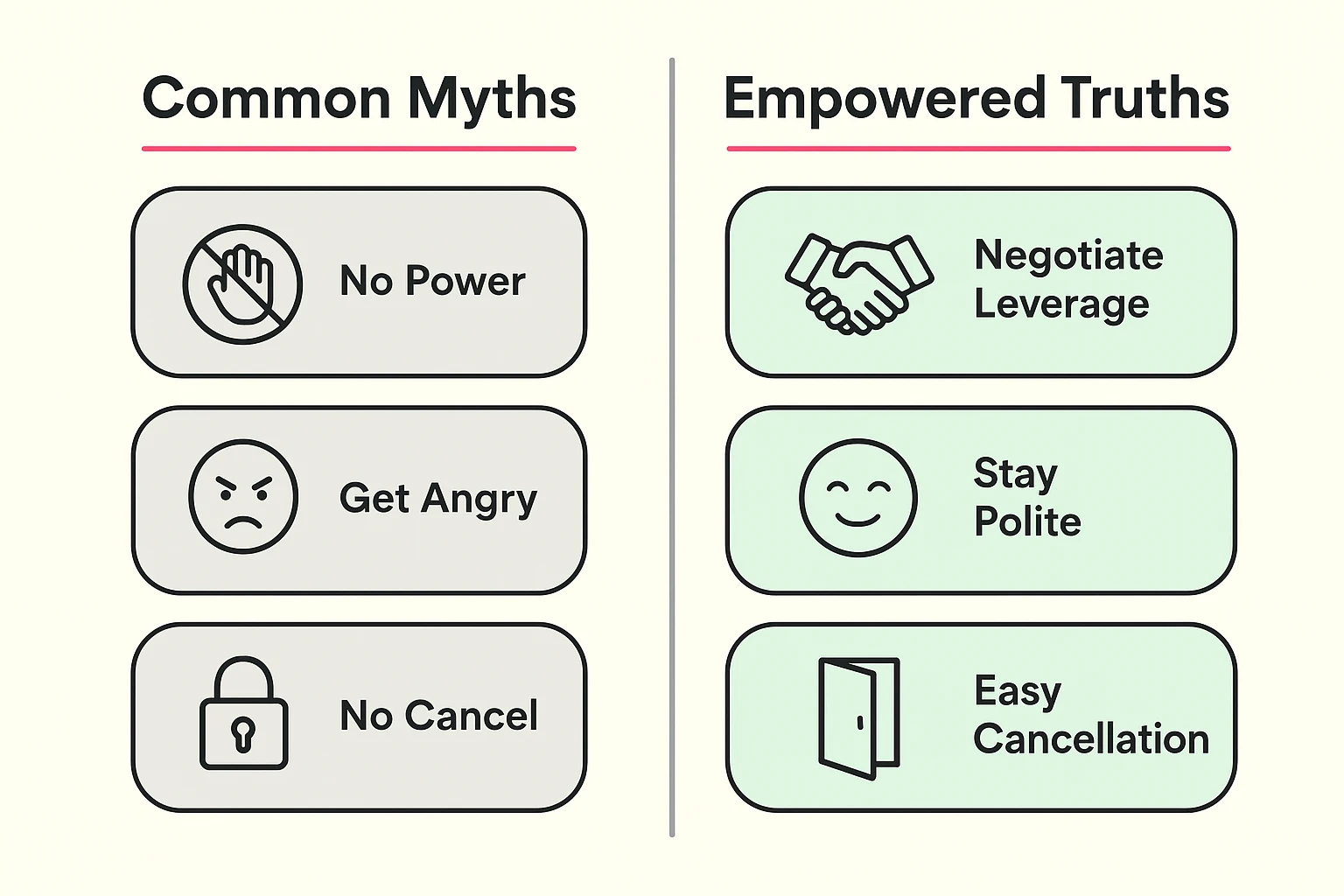

But here is the good news: You are not powerless. You are not a walking ATM. You are a customer with options, rights, and—after you read this—a very specific set of skills to handle this financial tomfoolery.

First, let’s clear up a misconception that many of us have. We tend to think that because we clicked “I Agree” on a Terms of Service document that was longer than War and Peace (and significantly less interesting), we have signed away our souls.

While you did agree to pay for the service, you didn’t agree to be tricked.

In the United States, the Federal Trade Commission (FTC) takes a dim view of “negative option marketing.” That’s fancy lawyer-speak for “charging you for things you didn’t explicitly say yes to.” If a company changes the terms of the deal—i.e., the price—they generally have to notify you. They can’t just sneak it in like extra zucchini in a chocolate cake.

If you are reading this from across the pond in the UK, the Digital Markets, Competition and Consumers Act (a mouthful, I know) provides similar protections against subscription traps.

The Golden Rule: If they hike the price, they must tell you. And—this is the important part—they must provide a simple way for you to say, “No, thank you, I would prefer to keep my money.”

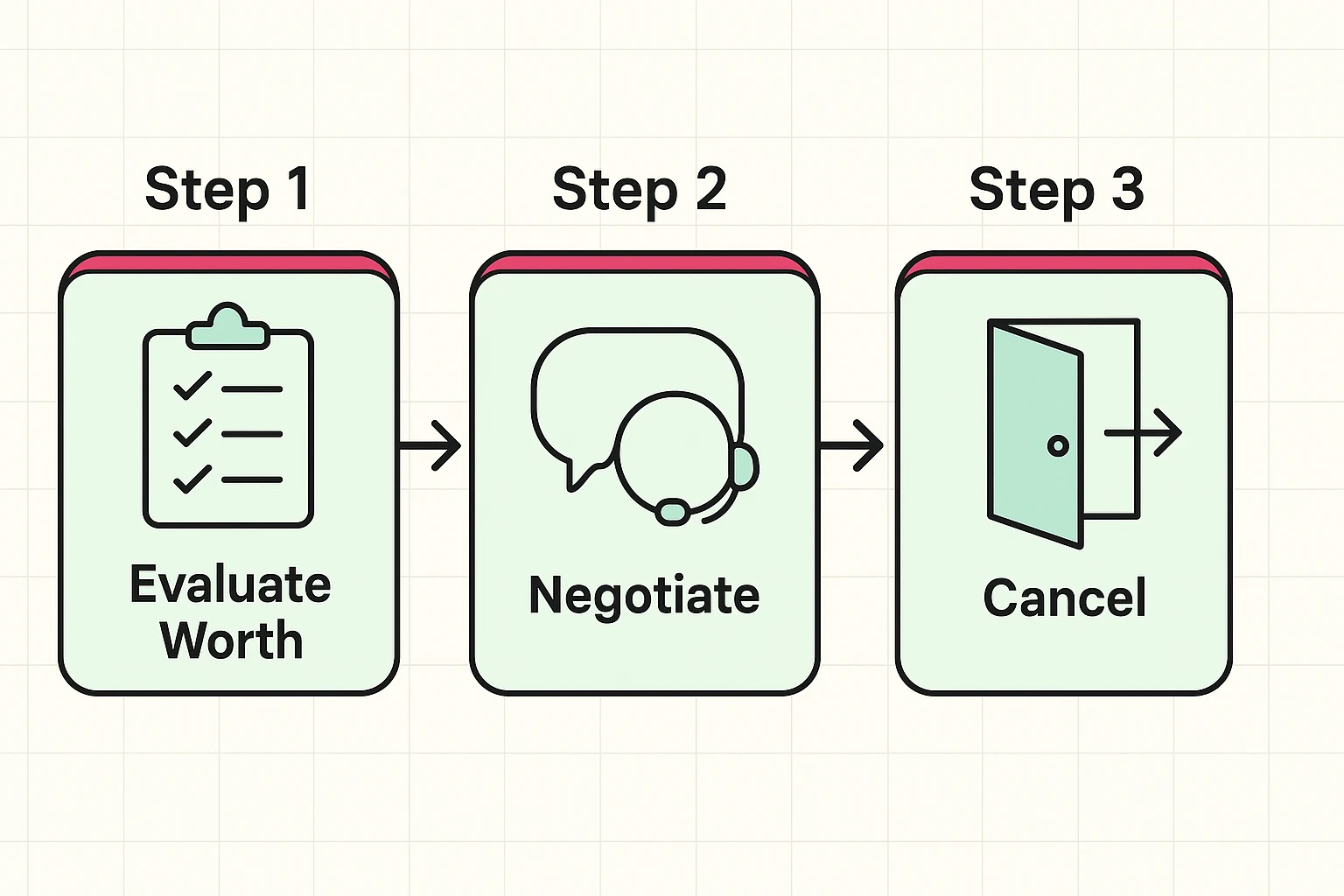

Before we storm the castle (or the customer support chat line), we need to take a breath and do a little math.

We often pay these new prices because of the “Lazy Tax.” It seems easier to pay the extra $3 a month than to figure out how to cancel. But $3 here and $5 there adds up to a nice dinner out or a very respectable stash of yarn.

Ask yourself these questions before you decide to fight or fold:

So, you’ve decided you want to keep the service, but you resent the price hike. It’s time to negotiate.

“Negotiate?” you ask. “I’m not buying a used car in a dusty lot!”

True, but subscription services are surprisingly flexible. They are terrified of “churn”—that’s business speak for “customers realizing they don’t need us and leaving.” They would rather keep you at a lower price than lose you entirely.

Here is your battle plan.

Call them or open the chat window. Be polite. Channel your inner sweet grandmother or grandfather who is just so confused by this new number.

What to say:

“Hi there. I’ve been a loyal customer for [Number] years. I noticed my bill is going up to [New Price]. I really enjoy the service, but that amount is outside my monthly budget. Is there any way to keep my rate at the previous price?”

Why it works: Customer service reps often have “retention offers” on their screens that they can only unlock if you ask. They want to give you a discount so you don’t rate them poorly on the survey at the end of the call.

If the nice approach doesn’t work, mention the other guys.

What to say:

“I see that [Competitor Name] is offering a deal for new customers at [Lower Price]. I’d prefer not to switch because I like you guys, but the price difference is significant. Can you match their offer?”

Why it works: It shows you’ve done your homework and aren’t afraid to walk away.

If they won’t budge on price, ask to pause your subscription. Many services allow you to freeze your account for 1 to 3 months.

Why it works: It saves you money immediately, and often, during the pause, the company will email you a “We Miss You!” coupon to entice you back at a lower rate. It’s playing hard to get, digitally.

If negotiation fails and the price is too high, it is time to say goodbye.

Under recent regulatory pressure, companies are being forced to adopt “Click-to-Cancel” principles. This means it should be as easy to get out as it was to get in. You shouldn’t have to call a phone number, listen to forty minutes of elevator jazz, and answer three riddles from a trollA troll is someone who intentionally causes trouble online by being disruptive or provocative, often... More just to stop paying for a magazine you don’t read.

Pro Tip: When you click “Cancel,” you will almost certainly be taken to a page that says, “Wait! Are you sure? How about 50% off for the next two months?”

It’s the digital equivalent of a boyfriend begging for one more chance. Take the discount if you want it. If not, click confirm and enjoy the feeling of that money staying in your pocket.

Technically, yes, provided they notified you. This notification usually comes in the form of an emailEmail, or electronic mail, is a digital communication tool that allows users to send and receive mes... More that looks suspiciously like spamSpam refers to unsolicited or unwanted messages, often sent in bulk, typically via email, text messa... More, or a small notice on your previous bill. If they raised it without any notice, you can dispute the charge with your credit card company.

It’s tricky, but possible. Call customer service and say, “I did not authorize this price increase and was not aware of the notification. I would like a refund for the difference.” If you are polite but firm, they may refund you as a “one-time courtesy.”

This is a classic “dark pattern”—hiding the exit. Search online for “[Company Name] customer service number” or look for a “Contact Us” linkA link, or hyperlink, is a tool used in electronic documents and websites to jump from one online lo... More usually buried in the footer (the very bottom) of their websiteA website is a collection of interconnected web pages or digital content that are accessible via the... More in tiny print.

No! Do not do this. If you just cancel the card, the subscription service will keep charging you, the charges will bounce, and they might send your account to collections. Always cancel the service directly.

Technology is supposed to make our lives better, not drain our bank accounts while we aren’t looking. Remember, these subscriptions serve you. You are the boss.

The next time you see that price jump, don’t just sigh and pay it. Evaluate it. Negotiate it. And if they don’t treat you right, cancel it with the confidence of someone who knows exactly what their banana bread recipe is worth (and it’s definitely not $19.99 a month).