Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

You know that feeling when you’re trying to find that one elusive key on your giant, jangly keyring? The one to the shed, maybe, or the mysterious “back gate” that hasn’t opened since 1987?

You jiggle, you squint, you try every single one, getting increasingly frustrated.

Now, imagine if, after you’re gone, your family had to do that for all your online accounts. Not just for a shed, but for bank accounts, social mediaSocial media refers to online platforms and websites that enable users to create, share, and interac... More, cherished photos, and perhaps even that secret online forum where you discuss the proper technique for competitive marshmallow roasting.

It’s a digital dilemma that’s becoming more real by the minute. Our lives are increasingly online, and while we might have a physical will for our earthly possessions, many of us haven’t even thought about a “digital will.”

This isn’t just about sharing your Netflix passwordA password is a string of characters used to verify the identity of a user during the authentication... More (though that’s a whole other family drama waiting to happen). This is about ensuring your loved ones aren’t left locked out of essential accounts when they’re already dealing with a difficult time.

Imagine the headache of trying to close accounts, recover photos, or manage bills without a single password. It’s enough to make anyone want to go back to carrier pigeons and handwritten letters.

At Senior Tech Cafe, we understand that thinking about your digital legacy can feel a bit like planning for a trip to the moon – important, but where do you even begin?

We’re here to be your friendly, jargon-free guide, helping you become the “Digital Keymaster” of your own online world, so your heirs can navigate it with ease, not exasperation. After all, the best way to avoid a digital treasure hunt is to provide a clear map.

Let’s face it, most of us don’t spend our weekends pondering our “digital afterlife.” Yet, for many families, navigating the digital remnants of a loved one can be as complex as an IRS audit and as emotionally draining as a soap opera marathon.

Surveys show that most Americans still have no plan for their digital assets. And with the average person juggling over 150 personal passwords (plus another 80 or so for work accounts), that’s a lot of locked doors.

Think about it:

The good news is that you don’t need a team of tech gurus or a magic wand. You just need a plan, some simple tools, and a clear head. We’ll walk you through the options, making sure you understand the “whys” as well as the “hows.”

When it comes to safeguarding your digital keys, you’ve got a few options, ranging from super-techy to good old-fashioned pen and paper. The best approach often involves a combination, tailored to your comfort level and your family’s needs.

The goal is always security and accessibility for your trusted heirs, without compromising your privacy or safety in the here and now.

Ultimately, you want a method that ensures your chosen representatives can eventually gain access, without exposing your entire digital life to the world (or your nosy neighbor) while you’re still enjoying it.

If you’re already using a password manager (and if not, what are you waiting for? They’re like having a digital butler for your passwords!), you’re already halfway there.

Modern password managers aren’t just for remembering “Fluffy2009!” anymore; many come with robust “emergency access” or “trusted contact” features specifically designed for digital legacy planning.

Here’s how they generally work:

This method is incredibly secure and efficient. Your passwords remain encrypted and hidden until absolutely necessary, and only to the people you trust.

It’s far better than taping a sticky note with all your passwords to the bottom of your keyboard (please don’t do that).

Tech security experts agree: a good password manager is one of the safest and easiest ways to protect your accounts. Think of it as a locked filing cabinet that holds all your keys in one place—and you can decide who gets the spare key when you’re gone. That makes it a smart foundation for your digital legacy.

You You’ve probably seen this: you type your password, then the site wants “one more thing”—a code texted to your phone, an appAn app (short for application) is a program that helps you do specific tasks on your smartphone, tab... More code, or even a little gadget you plug in. That’s called two-factor authentication (2FA). It’s fantastic for keeping the bad guys out, but it can also keep your family out if they need to handle your accounts after you.

Here’s how to make it easier for them:

This is one of the biggest stumbling blocks people forget about. Don’t let your heirs get locked out by a six-digit code. A little planning now saves a lot of headaches later.

For those who prefer a tangible “key” to their digital kingdom, a physical list is an option, but it comes with caveats. If you choose this route:

While less convenient than a digital solution, a physical list can serve as an excellent backup, especially for the “master password” to your password manager or for accounts that rarely change.

Just remember the old adage: “A secret written down is a secret half-told,” so guard it like your grandmother’s secret pie recipe.

Don’t forget the legal framework! While your will can’t give someone your passwords, it can grant your executor the legal authority to manage your digital assets. Similarly, a Durable Power of Attorney (POA) can empower someone to access and manage your accounts if you become incapacitated.

Having a will or power of attorney is important—it gives your family the official “permission slip” to deal with your accounts. But here’s the catch: those papers don’t automatically unlock everything.

Different tech companies play by different rules. Some may accept your documents right away, while others will want extra proof, sometimes even a court order. It can take weeks—or months—for them to grant access, and every company’s policy is a little different.

The bottom line: legal documents are essential, but they’re not a magic key. Pair them with tools like password managers and built-in legacy features (Google’s Inactive Account Manager, Apple’s Legacy Contact, etc.) so your family isn’t stuck waiting in paperwork limbo.

Here’s some rare good news: most U.S. states now have laws that cover what happens to your online accounts after you’re gone. The main one is called the Revised Uniform Fiduciary Access to Digital Assets Act—or RUFADAA for short, which honestly sounds more like a sneeze than a law.

In plain English, RUFADAA gives your executor (the person handling your will) or your power of attorney more legal muscle to ask for access to your accounts. That’s progress.

But—because nothing involving lawyers is ever simple—the details vary from state to state. And online companies often stick to their own terms of service first, which can override those laws. Translation: even with RUFADAA, your heirs might still run into digital red tape.

The takeaway: these laws are helpful, but they’re not a magic wand. If you want to make life easier for your family, it’s worth checking what your state allows and chatting with an estate planning attorney who understands digital assets. Think of it as getting a guide who actually knows the rules of the maze.

Many major tech companies, realizing the digital pickle people were getting into, have started offering their own legacy features. Think of these as built-in digital “dead man’s switches” – they only activate under specific circumstances and only for your chosen people.

It’s like setting up a special delivery service for your digital mail, but only after you’ve moved on to the great Wi-FiWi-Fi, short for Wireless Fidelity, revolutionizes connectivity by enabling devices to access the in... More in the sky.

GoogleGoogle is a multinational technology company known for its internet-related products and services, i... More, the behemoth behind Gmail, Google Photos, and YouTube, offers a fantastic tool called Inactive Account Manager. It lets you decide what happens to your data if your account becomes inactive for a set period (say, 3, 6, 12, or 18 months).

You can:

Setting this up is straightforward and provides immense peace of mind. It’s a proactive step that literally takes minutes, ensuring your digital legacy doesn’t become a cold case for your loved ones. This feature has been widely adopted by users who recognize the importance of planning ahead.

For those in the Apple ecosystem (iPhone, iPad, MacA Mac, short for Macintosh, is a line of personal computers developed by Apple Inc. Renowned for the... More), the Legacy Contact feature is your go-to. This allows you to designate someone who can access your Apple ID data, including photos, messages, notes, files, apps, device backups, and more, after your passing.

How it works:

This is a powerful tool for preserving cherished memories stored across your Apple devices. Just make sure your Legacy Contact knows they’ve been chosen and understands what to do!

Social media platforms have also caught up, offering various ways to manage accounts after death:

These features help preserve your online persona respectfully or ensure it’s removed according to your wishes. It’s about respecting your digital footprint, even after you’ve stopped scrollingScrolling is what you do when you move up or down on a screen to see more of a webpage, email, or do... More.

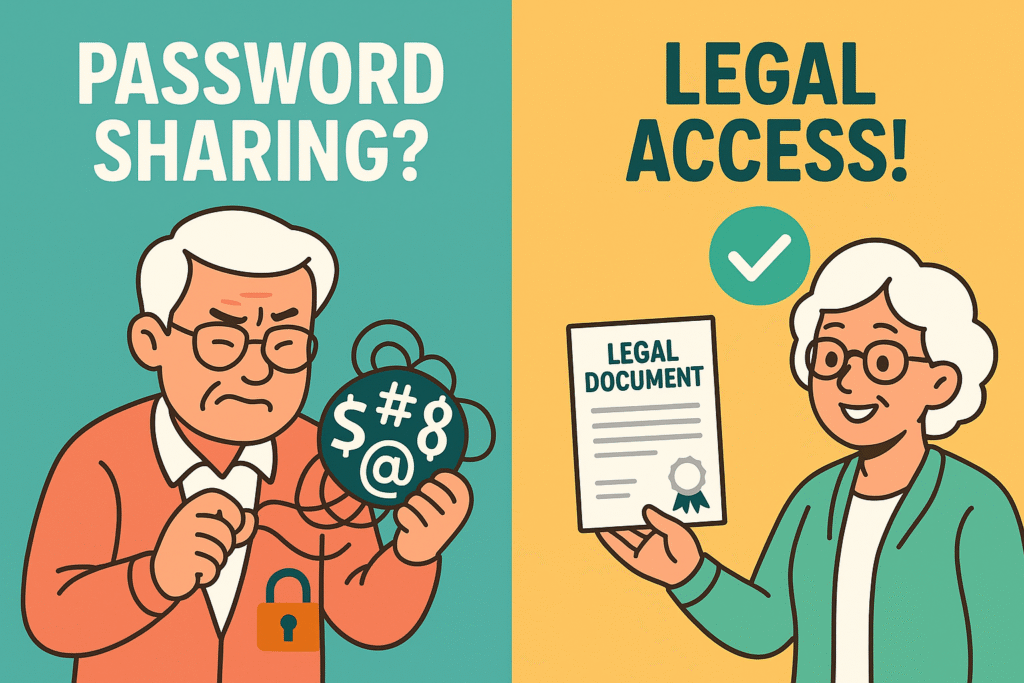

Now, this is where things get serious. There’s a world of difference between legally granting someone the right to manage your digital affairs and simply handing over a list of your passwords.

One is a solid plan; the other is like giving someone a skeleton key to your house and hoping they only use it for good.

Tempting as it might be to just give your son or daughter your spreadsheet of passwords, here’s why it’s generally not a great plan while you’re still alive:

This is where legal documents like a Durable Power of Attorney (POA) or your will designating an executor truly shine. These documents grant a trusted individual (your “fiduciary”) the legal right to act on your behalf or manage your estate, including your digital assets.

With a legal POA, your agent can:

An executor named in your will has similar powers after your passing. While they still won’t magically know your passwords, the legal document gives them the standing to request access from companies, often with a death certificate. This process, while sometimes slower than a password manager, is the most robust and legally sound way to handle your digital estate.

It’s a critical piece of your overall online safety and privacy strategy. Understanding these legal distinctions protects your assets, your privacy, and prevents unnecessary stress for your family.

Don’t be one of the 65% of adults who don’t have a digital plan included in their estate planning, because dealing with a digital lockbox without the right keys or legal standing is an ordeal nobody wants.

At Senior Tech Cafe, we don’t just talk about tech; we translate it into plain English, seasoned with a bit of humor, so you can make informed decisions.

When it comes to something as vital as your digital legacy, we’re committed to giving you clear, actionable steps without the usual tech-bro jargon that makes your eyes glaze over.

Our articles are designed to be that trusted advisor, like a friendly neighbor who actually knows how to fix your Wi-Fi. We focus on:

We believe that understanding your digital choices empowers you. It’s not just about buttons and settings; it’s about peace of mind for you and your loved ones. Our approach is backed by certified security standards and trusted platform partnerships to protect your digital legacy.

Thinking about your digital legacy often brings up a flurry of questions. Let’s tackle some of the most common ones.

Absolutely! While your kids might be digital whizzes, they still can’t magically guess your passwords or circumvent privacy settings without your explicit instructions or legal authority. Imagine them trying to cancel a subscription service or access your online photo library after you’re gone. It’s not about tech savviness; it’s about access and authority. Many people report being locked out of deceased loved ones’ accounts, even when they’re technically skilled—the barriers are legal and procedural, not just technical.

Yes, ironically, it’s safer than writing them down or using the same password everywhere. A good password manager uses military-grade encryptionEncryption is a way to protect sensitive data by turning it into unreadable code using complex math.... More, meaning your data is scrambled into an unreadable mess that only your master password can unlock. The legacy features are designed with additional layers of security and verification. Think of it as putting all your valuables in one super-secure bank vault, rather than scattering them in various shoeboxes around the house.

No problem! All these systems (password managers, Google’s Inactive Account Manager, Apple’s Legacy Contact) allow you to change or revoke designated contacts and modify settings at any time. It’s like changing your will – you’re in control until you’re not.

Photos are often the most emotionally valuable digital assets. Both Google Photos (via Inactive Account Manager) and Apple iCloud (via Legacy Contact) have specific provisions for sharing or transferring photo libraries. Many password managers can also help your heirs access photo accounts like Flickr or SmugMug. Prioritizing photo access is a common and wise choice.

Not directly through password managers or platform-specific legacy features. While these tools can help them gain access to the login credentials, the actual management of financial accounts still requires legal authority. Your executor or someone with a Durable Power of Attorney will still need to present those legal documents to banks and financial institutions, even if they have the login details. This is an important distinction between technical access and legal authority.

Thinking about what happens to your digital life after you’re gone isn’t a morbid exercise; it’s a responsible and loving act. By taking a few proactive steps today, you can spare your family immense frustration, protect your memories, and safeguard your financial affairs.

You’re not just organizing passwords; you’re building a digital bridge for your loved ones to cross, ensuring they can seamlessly manage your legacy without getting stuck in a technological labyrinth.

We encourage you to explore the options we’ve discussed: consider a robust password manager with legacy features, activate Google’s Inactive Account Manager, set up an Apple Legacy Contact, and review your legal estate planning documents to ensure they cover your digital assets.

Don’t let your digital life become a mystery novel for your heirs. Start planning today, and let Senior Tech Cafe be your guide on this important journey. Sign up for our newsletter for more plain-English tech advice, humor, and helpful tips!