Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Let’s play a game of “what if.” What if, while attempting to retrieve a Frisbee from your roof (a decision that seemed perfectly reasonable at the time), you have a sudden, unscheduled meeting with gravity? You’re whisked away to the hospital, you’re fine, but a bit loopy from the good stuff they give you.

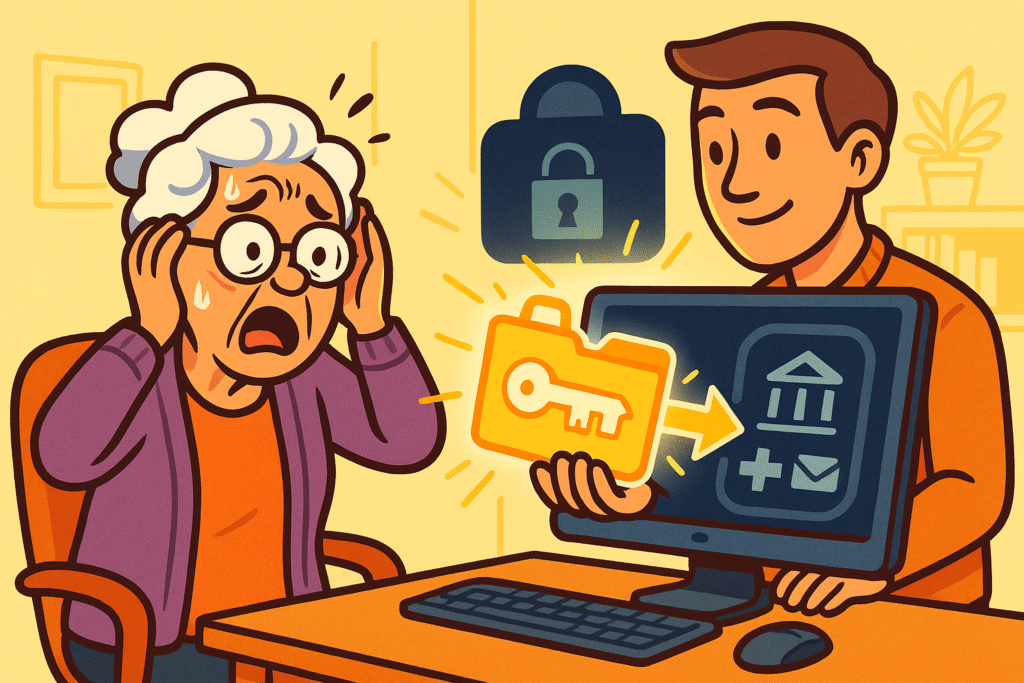

Meanwhile, back at home, your spouse realizes the mortgage payment is due tomorrow. The bill is paperless. The login is saved on your computer. The passwordA password is a string of characters used to verify the identity of a user during the authentication... More is known only to you and a squirrel you once muttered it to. Your spouse is now locked out of your financial life, facing a ticking clock and a computer screen that might as well be written in Klingon.

This isn’t a scene from a disaster movie; it’s a modern-day predicament. We’ve wrapped our lives in layers of digital security, which is great for keeping out nosy neighbors and cyber-scoundrels. But in a real emergency, that same security can lock out the very people who need to help you most.

This is where an Emergency Access Toolkit comes in. Think of it not as a morbid “what happens when I’m gone” plan, but as a practical “what happens if I’m temporarily out of commission” lifeline for your family.

Simply put, an Emergency Access Toolkit is a secure, pre-arranged way for a trusted person—like your spouse or adult child—to get temporary access to your critical digital accounts if you’re suddenly unable to manage them yourself.

It’s not about giving them the keys to your entire kingdom forever. It’s about giving them a temporary guest pass to handle urgent business, like paying bills, contacting your doctor, or managing insurance claims while you’re recovering.

This is fundamentally different from digital estate planning, which deals with what happens to your accounts after you’ve permanently logged off. This toolkit is for the “in-between” moments—the unexpected hospital stays, the sudden illnesses, the moments when life throws you a curveball.

The goal is peace of mind. For you, knowing that things won’t fall apart. For your family, knowing they can help without the added stress of a digital scavenger hunt.

Creating this toolkit isn’t as daunting as it sounds. You don’t need a degree in computer science, just a bit of planning.

First, figure out which accounts are actually critical in a crisis. Not every login is a life-or-death matter. Your family probably doesn’t need immediate access to your online bird-watching forum.

Grab a piece of paper and divide it into three categories:

Focus on Tier 1 first. You can always add the others later.

This is the person you’ll grant emergency access to. It should be someone you trust implicitly, like your spouse, partner, or a responsible adult child. Have a conversation with them. Explain what this is for and what their role would be. This isn’t a fun chat, but it’s a lot less stressful than having it in a hospital waiting room.

You have a few good options here, ranging from high-tech to reassuringly old-school. Writing your passwords on a sticky note taped to your monitor is not one of them.

Method A: The Password Manager

If you’re already using a password manager—and you should be—this is the easiest route. Most major services like LastPass, 1Password, and Keeper have a built-in “Emergency Access” feature.

Here’s the gist: You designate your Digital Deputy and set a “wait time” (say, 24 hours). If they ever need access, they hit a button. You then have 24 hours to deny the request. If you don’t (because you’re busy arguing with a jello cup in a hospital bed), they’re granted access. It’s secure, controlled, and you can learn more about how to set one up in our guide, Why You Need a Password Manager (and How to Choose One).

Method B: The Offline Solution

For those who prefer something they can hold, you can create a physical kit. Type up your Tier 1 account information (websiteA website is a collection of interconnected web pages or digital content that are accessible via the... More, usernameA username is the special name you choose when you create an account online—like for email, Facebo... More, password) and store it securely.

This flowchart breaks down complex emergency access setup into manageable steps, covering various secure methods and MFAMulti-factor Authentication (MFA) is a security feature that adds an extra layer of protection to yo... More handling to empower families with clear, actionable choices.

Here’s the modern-day wrinkle: Two-Factor Authentication (2FA2FA, or Two-Factor Authentication, is a security measure that uses two different types of proof to v... More). It’s that extra code you need from your phone to log in, and it’s a fantastic security measure. We even call it Two-Factor Authentication: Your Digital Seatbelt.

But in an emergency, if your Deputy has your password but your phone is in a hospital property bag, they’re still locked out.

Here’s how to handle it:

An emergency kit is not a crockpot—you can’t just “set it and forget it.” Life changes. You open new accounts, close old ones, and change passwords (or you should be!).

Set a calendar reminder to review your Emergency Access Toolkit once a year. Your birthday or New Year’s Day are great times to do it.

Check that:

This small annual check-up ensures that when an emergency does happen, your carefully laid plan actually works. Don’t forget to think beyond just passwords—include information on how to access important files in cloud storage"The cloud" refers to storage and services that are accessed over the internet instead of being stor... More or your family photos. This is a stepping stone to a more complete plan, which you might consider as part of a The Senior’s Guide to Digital Estate Planning.

Sharing your master password directly is a huge security risk. If their device gets compromised, your entire digital life is exposed. The “Emergency Access” features in password managers provide a secure, one-way street for access only when it’s truly needed, and often with read-only permissions to start.

Once a year is a great rule of thumb. Also, be sure to update it after any major life event, like opening a new bank account, switching insurance providers, or finally getting rid of that email address from 1998.

Technically, sharing passwords often violates a website’s terms of service. However, in a genuine emergency, having a loved one pay a critical bill or access medical information is a practical necessity. This toolkit is for true emergencies, not for letting your son check your email for you. (Disclaimer: We’re tech experts, not lawyers, so consult a legal professional for formal digital estate advice).

No problem! The offline methods—like an encrypted USB drive or a sealed envelope in a safe—are powerful and secure alternatives. The most important thing is that the information is accurate and stored safely where your trusted person can find it when needed.

Getting your digital house in order for an emergency is one of the most thoughtful things you can do for your family. It replaces panic with a plan and frantic searching with clear instructions.

You don’t have to do it all today. Start small. This week, just identify your three most critical “Tier 1” accounts. Write them down. That’s it. You’ve already taken the biggest and most important step toward giving your family—and yourself—invaluable peace of mind.