Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Have you ever thought about what happens to your emailEmail, or electronic mail, is a digital communication tool that allows users to send and receive mes... More, your Facebook photos, or your online banking account after you’re gone? If you haven’t, you’re not alone.

For most of us, planning for the future involves dusty files and important-looking papers. We think about the house, the car, and who gets Aunt Mildred’s prized collection of porcelain cats.

But our digital stuff? That often feels like a problem for another day. It’s like leaving your loved ones a treasure chest, but the map is written in emojis and the key is a passwordA password is a string of characters used to verify the identity of a user during the authentication... More you once created based on your first pet’s name, the street you grew up on, and a random number you saw on a license plate in 1987. Good luck with that.

The idea of organizing your entire online life can feel as daunting as trying to fold a fitted sheet. But here’s the good news: creating a plan for your digital assets—a “digital will”—is far easier than you think. It’s not about becoming a tech wizard overnight. It’s about creating a simple roadmap so your family isn’t left playing a frustrating game of digital hide-and-seek.

First, let’s clear up some confusion that would make a lawyer’s head spin. When we talk about a “digital will,” we’re not usually talking about a formal legal document you file with the courts. Think of it more like a detailed instruction manual for your online life.

When people say ‘digital will,’ they usually mean an informal instruction manual: a secure list of your online accounts plus notes on what you want done with them. Lawyers usually call this a digital estate plan or digital asset inventory.

Your digital assets are everything you own or manage online, including:

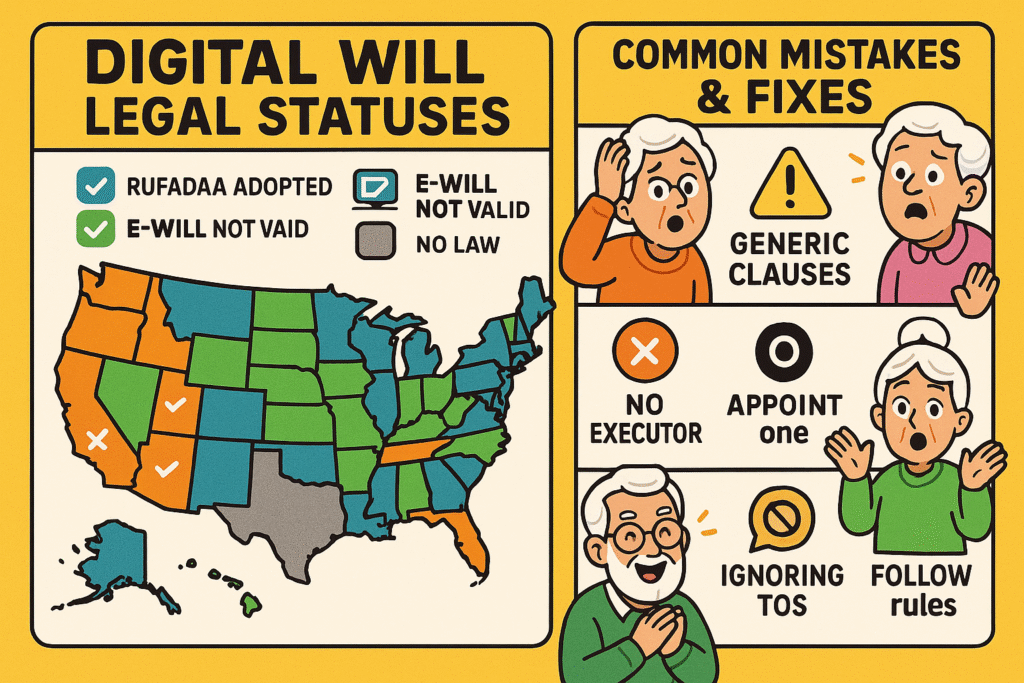

That’s different from an electronic will, which is a formal, legally binding will created and signed electronically. Electronic wills are only recognized in some states and have strict rules. For our purposes, we’re focusing on creating the instruction manual, not the legally binding electronic document.

Without a plan, your family could face a digital brick wall. Tech companies are notoriously protective of user privacy, and they won’t grant access to an account without the proper legal authority. This can mean precious photos are lost forever and financial loose ends become massive headaches.

Most states now use a law called RUFADAA. It allows your executor to handle digital accounts if you explicitly give them that power in your will. But even then, providers may limit what’s allowed—they often let data be downloaded but not accounts transferred.

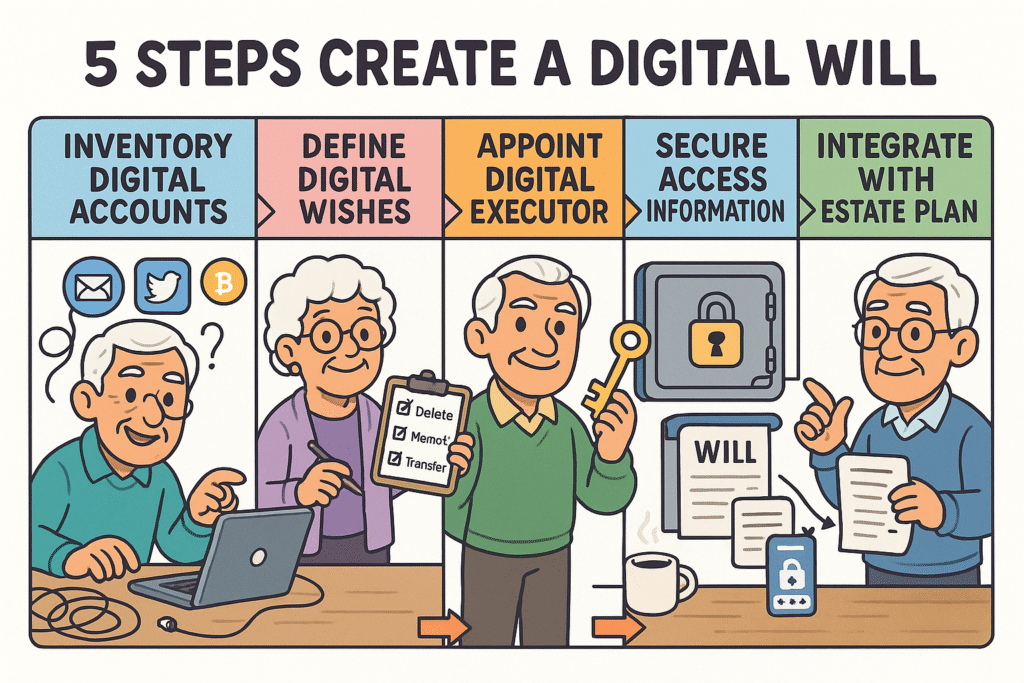

Ready to tackle this? Forget the legal jargon and complex flowcharts. We’re going to break this down into five simple steps. Think of it as organizing a closet: it seems scary at first, but once you get started, it’s just a matter of sorting things into piles.

This step-by-step flowchart breaks down the digital will creation process into manageable actions, empowering you to confidently secure your digital legacy without overwhelm.

Grab a notebook or open a document on your computer. Start listing every online account you can think of. Don’t worry about getting it perfect on the first try. Just start writing. To make it easier, break it down by category:

For each account, just list the websiteA website is a collection of interconnected web pages or digital content that are accessible via the... More and your usernameA username is the special name you choose when you create an account online—like for email, Facebo... More. That’s it for now!

Now, go back through your list. Next to each account, decide what you want to happen to it. Do you want your Facebook profile to be memorialized (a feature Facebook offers)? Do you want your email account deleted after your executor retrieves important documents? Or do you want your photo library passed on to your children? Your wishes, your rules.

Pick your digital helper. Call them a ‘digital executor’ if you like, but legally they’ll just be your executor with special instructions. Choose someone you trust who isn’t scared of logging into a website.

This is the most important step. You have a list of all your accounts, but how does your executor get in? Warning: Do NOT put your passwords directly in your will. Your will becomes a public document once it goes through probate, and you don’t want your login information available for all the world to see.

The best solution is to use a password manager. Think of it as a digital vault that stores all your passwords under one single, strong master password. Many services, like 1Password or LastPass, even have features designed for this exact situation, allowing you to grant emergency access to a trusted person. You simply need to give your digital executor instructions on how to access this vault—not the hundreds of passwords inside it.

In your formal will, add a clause saying your executor has authority to manage your digital assets according to your separate instructions. Have a lawyer draft or review this to make sure it stands up in your state.

This connects your instruction manual to your legal will without exposing any sensitive information.

You’ve done the hard part! Now, let’s make sure your plan is solid by avoiding a few common traps. Many people think a cheap online will service is good enough, but these can sometimes create more problems than they solve, especially with digital assets.

This infographic helps you remember key legal realities across states and common digital will mistakes with simple fixes, making complex legal variations and pitfalls easy to recall.

While this process is easier than you think, it’s always a good idea to have an estate planning attorney review your final legal will to ensure it complies with your state’s laws and effectively protects your digital legacy.

Your digital life is always changing, so your plan should, too. Set a reminder to review your digital asset inventory once a year. Add new accounts, remove old ones, and make sure your wishes are up to date.

Creating this plan is one of the most thoughtful gifts you can give your loved ones. You’re saving them from immense stress, confusion, and heartache during an already difficult time. You’re giving them clarity and peace of mind.

A digital will is your informal instruction manual and inventory. An electronic will is a formal, legally-signed digital version of a traditional will, and it’s only valid in some states.

Yes! If you use email, online banking, or social media, you have digital assets. Without a plan, they could be lost forever or cause significant legal and financial problems for your family.

Please don’t. A will becomes a public record. A much safer method is using a secure password manager and giving your executor instructions on how to access that single vault.

Choose someone you trust implicitly who is also comfortable navigating websites and apps. It doesn’t have to be a computer genius, just someone who won’t be intimidated by logging into an account.

Your family will have to go to court to try to get access to each account, which is expensive, time-consuming, and often unsuccessful. It can lead to lost family photos, missed financial information, and a mountain of frustration.

Great question! Your instruction manual should include information about how you use 2FA—for example, noting which phone number or device receives the codes. Your digital executor will need access to that device to log in to secure accounts.

See? You’ve just navigated the world of digital estate planning. It’s not a scary legal maze; it’s a logical process of getting organized. By creating a simple inventory and a clear set of instructions, you’re taking control of your digital legacy and protecting your family from a world of trouble.

Now, go grab a notebook. Your first step is as simple as writing down “Gmail.” You’ve got this.