Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Picture this: years from now, your family is gathered to celebrate your life. They’re swapping stories, laughing at your legendary dance moves, and trying to put together a slideshow of your greatest hits—the grandkids’ graduations, the holiday photos where no one blinked, and that fishing trip where the boat caught fewer fish than mosquito bites.

Here’s the catch: all those photos and important files are trapped inside your computer, guarded by a passwordA password is a string of characters used to verify the identity of a user during the authentication... More so complicated it might as well be the nuclear launch code.

Back in the day, estate planning meant passing along photo albums, a few important papers, and maybe the key to a safe deposit box. Now, our lives live in the digital attic—a place filled with priceless memories, financial accounts, and, yes, a few questionable search histories you’d rather keep buried.

Leaving behind a tangle of logins is the modern equivalent of leaving your will scribbled on the back of a grocery receipt. Let’s talk about how to organize your digital life so your loved ones can remember you fondly—without also remembering how many times they cursed at your computer trying to get in.

Before we start, let’s clear something up. “Digital assets” sounds like something from a science fiction movie, but it’s really just all your online “stuff.” It’s more than just your bank account password.

Think of it in a few categories:

BobsBestBBQ.com), or an online store.Now for the million-dollar question: do you actually own all of it? The answer is a big, fat “it’s complicated.” You might own a photo you took, but you don’t own your Facebook account. You are merely licensing it.

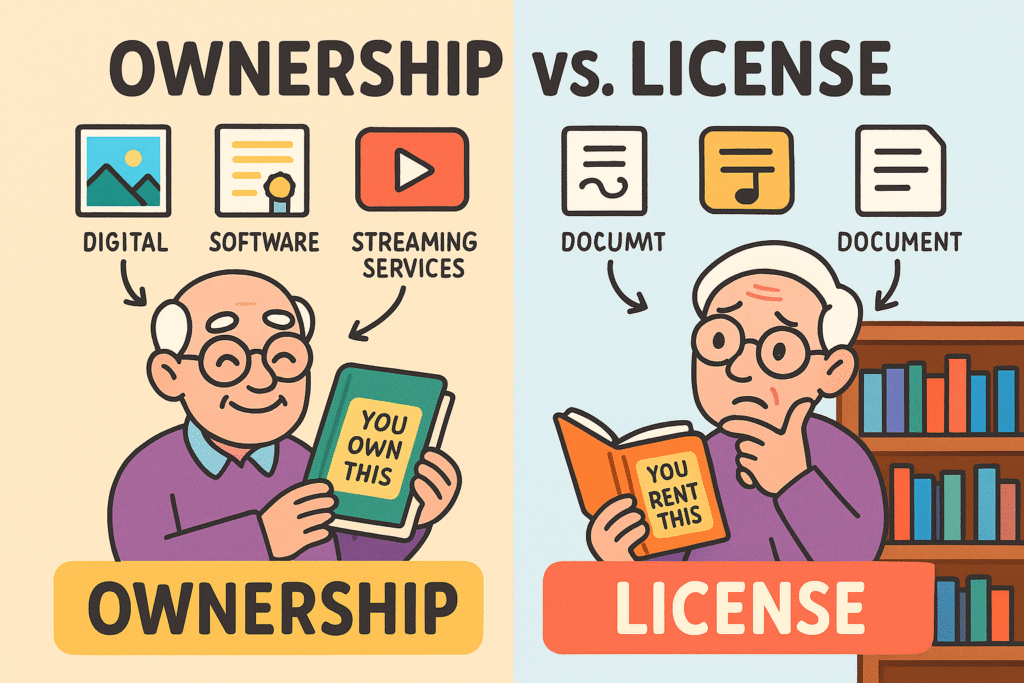

Think of it like this: buying a digital photo is like buying a painting. It’s yours. But using a social media account is like having a library card. You can use the library, but you don’t own the building, and you have to follow their rules. This “Ownership vs. License” distinction is critical because many services have rules (in their miles-long Terms of Service) about who can access an account after the owner passes away.

Understanding ‘Ownership vs. License’ is crucial: owning digital assets means heirs can inherit them, while licensed assets often cannot be transferred. This visual metaphor demystifies the difference for easier planning.

To help with this mess, most states have adopted a law with a ridiculously long name: the Revised Uniform Fiduciary Access to Digital Assets Act (RUFADAA). All you need to know is that this law provides a three-tiered system for who gets to access your digital stuff. It’s a good start, but it’s not a magic wand. Having a clear plan is still the best way to make sure your wishes are followed.

Creating a digital estate plan isn’t about filling out complex legal forms. It’s about creating a simple, clear roadmap for your loved ones. Let’s break it down into manageable bites.

You can’t organize what you don’t know you have. The first step is to take inventory. Grab a notebook or a spreadsheet and start listing your digital assets. Don’t just list “Facebook”; write down the login email, a hint for the password’s location (more on that later), and any security question answers.

Be thorough! Think about:

For each asset you list, decide what you want to happen to it. Do you want your Facebook profile memorialized so friends can share memories? Do you want your personal emails deleted forever? Should your massive online collection of recipes be passed down to your foodie nephew?

Write down your wishes for each account. This simple instruction—”Delete,” “Memorialize,” “Transfer to my daughter, Jane”—is immensely helpful. It removes the guesswork and guilt for your family.

You need to name a “digital executor”—the person responsible for carrying out your digital last wishes. This person should be two things: trustworthy and at least moderately tech-savvy. You don’t need a Silicon Valley whiz kid, just someone who won’t panic when faced with a login screen.

This could be the same person who is the executor of your will, or it could be a different, more tech-comfortable family member or friend. The important thing is to ask them first! Make sure they’re willing and able to take on the role.

Okay, you’ve got your list and your wishes. Where do you put it? Do NOT put your actual passwords in your will. A will becomes a public document once it goes through probate, and you don’t want your Amazon password available for public viewing.

Instead, use a secure method:

Following general cybersecurityCybersecurity is a critical field dedicated to safeguarding digital systems, networks, and data from... More best practices, like using two-factor authentication (2FA) and a secure digital safe like a password manager, makes this whole process safer and easier.

Once you have your plan, mention it in your will. You don’t need to include the details, just a statement giving your digital executor the authority to manage your digital assets. Something like, “I grant my executor, [Executor’s Name], the authority to access, manage, and distribute my digital assets as outlined in the separate document titled ‘My Digital Estate Plan.'”

This gives them the legal standing they need to work with tech companies. It’s always a good idea to chat with an estate planning attorney to make sure your will and digital plan work together seamlessly.

Feeling a bit overwhelmed? Don’t be. You don’t have to do this all in one afternoon. Just start.

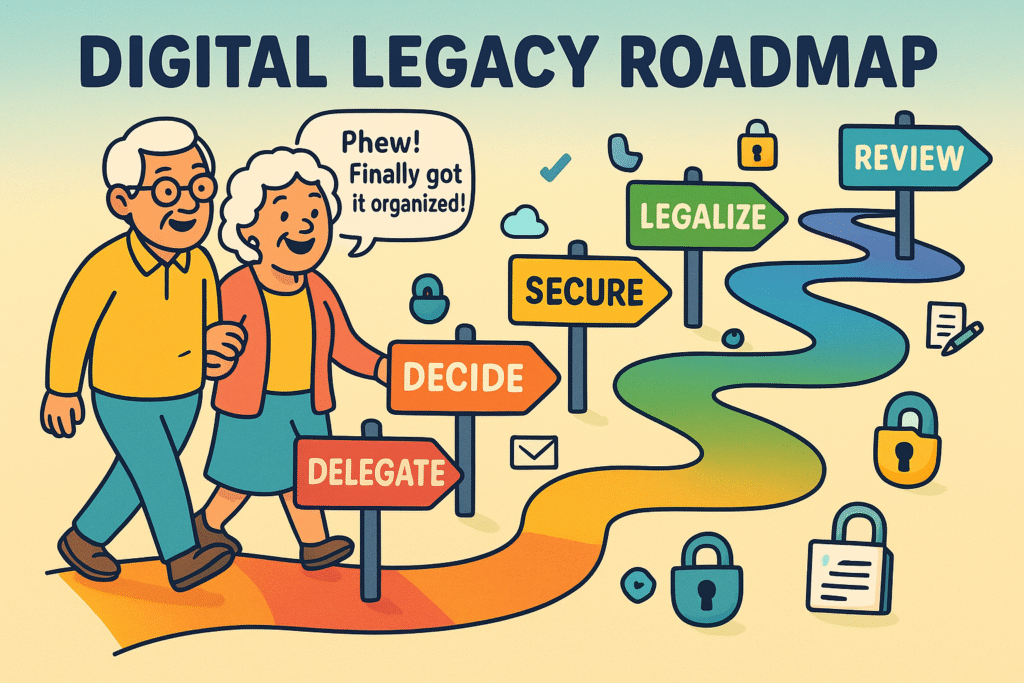

Here’s a simple roadmap:

This Digital Legacy Roadmap serves as a memorable guide, helping you recall and follow the essential steps to plan your digital estate comprehensively and confidently.

Think of this as another part of getting your house in order. Tackling it now is one of the kindest, most thoughtful things you can do for your family, ensuring your digital life is a legacy, not a burden.

Your will handles your physical and financial property (your house, car, and bank accounts). A digital estate plan is a guide for your online property (your email, photos, and social media). The two should work together, with your will giving your executor the legal power to follow your digital plan.

Please don’t! Wills often become public records. Putting your passwords in there is like posting them on a community bulletin board. It’s a major security risk for your estate and your family.

Choose someone you trust completely who is also comfortable with technology. It could be one of your kids, a grandchild, or a tech-savvy friend. The most important thing is that they are responsible and willing to do it.

A good rule of thumb is to review your digital plan once a year, or whenever you make a big change, like creating a new important online account or changing your primary email address. It’s a living document