Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Back in the day, handling someone’s affairs was a dusty, analog affair. You’d find a shoebox under the bed labeled “IMPORTANT STUFF,” filled with a will, some bank statements, and maybe a few cryptic notes like “Combination to the shed is the dog’s birthday.” It was a treasure hunt, sure, but at least all the clues were in one physical place.

Fast forward to today. Your life isn’t just in a shoebox; it’s scattered across the digital universe. It’s in your email, your Facebook memories, your online banking portal, that secret cloud folder of terrible vacation photos, and the dozen streamingStreaming refers to the process of transmitting or receiving multimedia content, such as audio, vide... More services you’ve subscribed to.

If something happens to you, your loved ones won’t be looking for a shoebox. They’ll be facing a wall of login screens, each one a digital bouncer demanding a passwordA password is a string of characters used to verify the identity of a user during the authentication... More you took to the great beyond.

Many people think the solution is simple: just jot down your passwords and give them to your kids. But that’s like giving someone the master key to your entire life while you’re still living in it. It’s messy, insecure, and can create a spectacular digital train wreck. There’s a much smarter, safer way to handle this: appointing a digital executor.

Before we dive in, let’s get on the same page. When we say “digital assets,” we’re not just talking about BitcoinBitcoin is a decentralized digital currency that operates on a peer-to-peer network without the need... More you bought as a joke in 2015. It’s a huge category of stuff that includes:

Think of it as your digital attic—a sprawling collection of your financial records, photo albums, personal letters, and filing cabinets. The problem is, this attic has a thousand different locks, and most traditional wills don’t even mention that it exists. Tech companies have their own rules (called Terms of Service) that often prevent anyone, even family, from accessing an account after the owner passes away.

Digital assets include everything from social media accounts to cryptocurrency and emails — your digital safe that needs special planning beyond traditional wills.

This creates a massive gap in estate planning. Your will might say who gets the house, but it probably says nothing about who gets to download"Download" means saving something from the internet onto your device—like your phone, tablet, or c... More your family photos or shut down your Facebook profile to stop those awkward automated birthday reminders.

This seems like the easiest solution, right? A sticky note with “Gmail: Fluffy123!” on the fridge. Done. Except, this is one of the worst things you can do. It’s the digital equivalent of leaving your house keys, car keys, and safe deposit box key under the doormat with a sign that says, “Help yourself!”

Here’s why just sharing passwords is a terrible idea:

So, if a password list is out, what’s in? A digital executor.

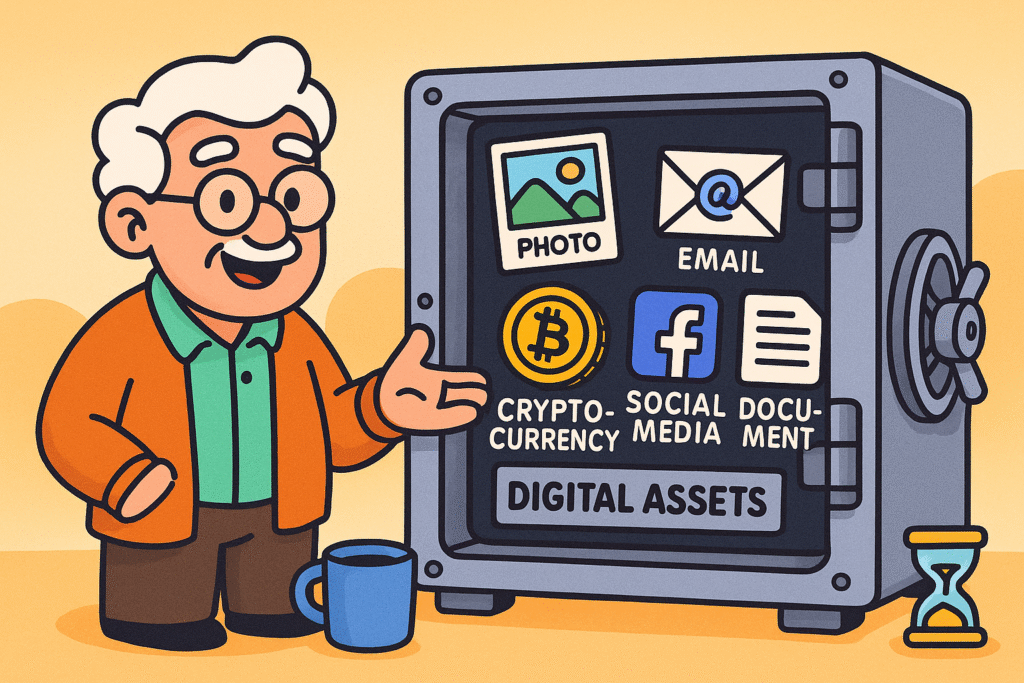

This is a person you legally authorize to manage your digital assets after you’re gone or if you become incapacitated. They don’t just have a password; they have the legal authority to access, manage, and distribute or delete your digital property according to your wishes. Think of them as the designated driver for your digital life.

Choosing the right person is crucial. You need someone trustworthy, of course, but also someone who isn’t afraid of a computer. They don’t need to be a Silicon Valley genius, but they should know the difference between a browser and a search engineA search engine is a powerful digital tool that scours the vast expanse of the internet to find rele... More.

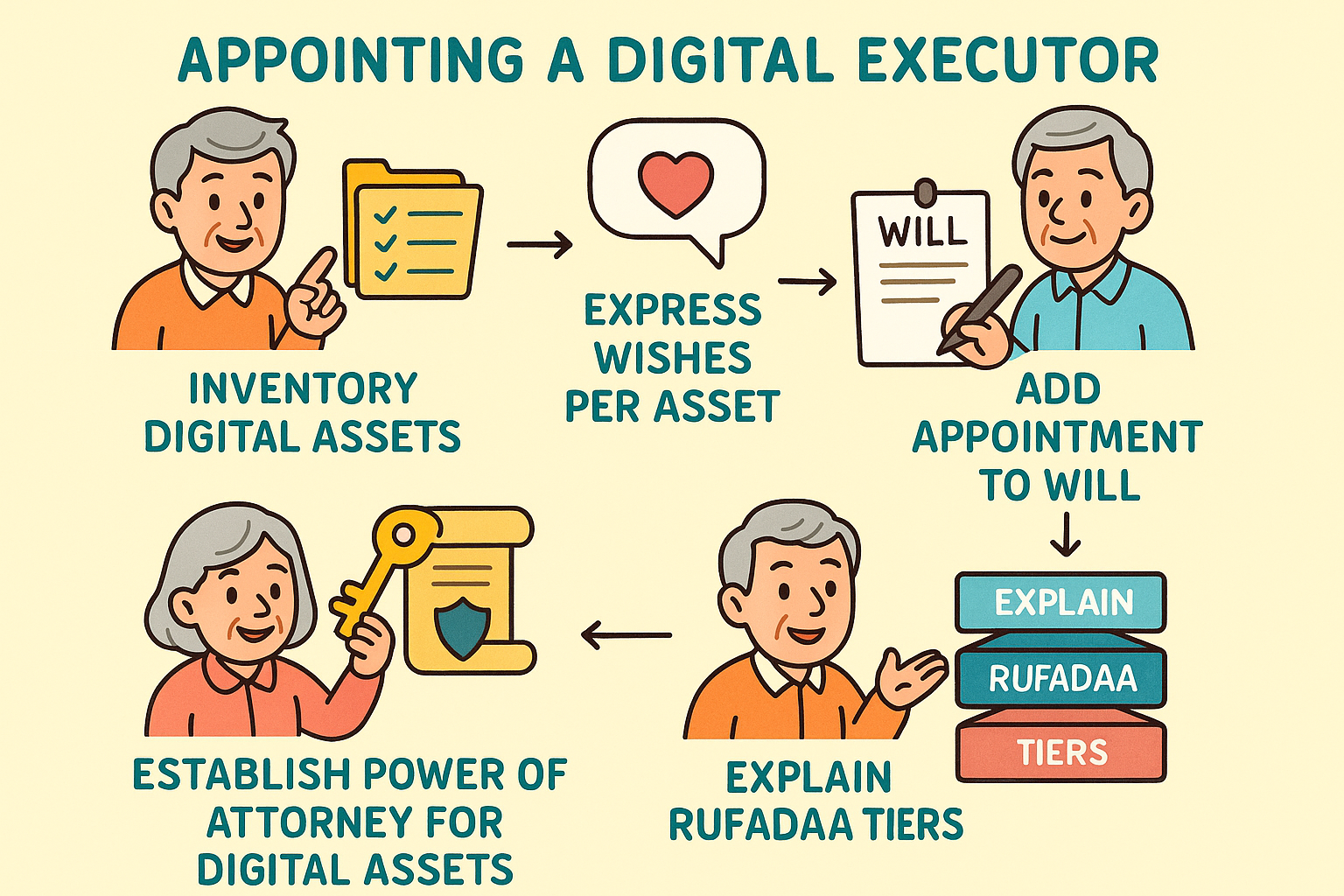

Appointing a digital executor involves clear legal steps from listing your assets to integrating legal documents and understanding RUFADAA’s role, ensuring secure access without oversharing.

Here’s how you actually do it:

Step 1: Create an Inventory. You can’t plan for what you don’t know you have. Make a list of your digital assets. Don’t list the passwords here! Just the accounts: Gmail, Wells Fargo online, Facebook, Netflix, etc.

Step 2: State Your Wishes. For each asset, write down what you want to happen. Do you want your Facebook profile memorialized or deleted? Should your emails be wiped clean or archived for your family? Be specific.

Step 3: Make It Legal. This is the most important part. You need to grant legal authority in your official estate planning documents. This can be done by:

This sounds like a character from a sci-fi movie, but RUFADAA (Revised Uniform Fiduciary Access to Digital Assets Act) is a law adopted by most states to create a legal framework for this stuff. It basically sets up a three-tiered pecking order for who gets to call the shots:

Okay, so you’ve legally named a digital executor. Now, how do they actually get in without you giving them your passwords today? This is the “secure access without giving away the farm” part.

The answer is a password manager.

Think of a password manager as a super-secure digital vault. You put all of your passwords inside, and you only have to remember one master password to open it. It’s far more secure than a notebook or a spreadsheet.

Most top password managers have an “emergency access” feature. You can designate a trusted person (your digital executor) to request access to your vault. The service will then notify you. If you don’t respond within a set time period (say, 48 hours), access is automatically granted to them.

This is the perfect solution. It keeps your accounts secure while you’re alive and provides a seamless, legal way for your executor to gain access only when it’s needed. You’re not handing over the keys to the kingdom; you’re just telling the gatekeeper who to give them to in an emergency.

Feeling a bit overwhelmed? Don’t be. Here’s a simple checklist to get you started.

Your regular executor handles your physical stuff—your house, car, and bank accounts. Your digital executor specifically deals with your online assets. They can be the same person, but it’s often helpful to name someone who is more tech-savvy for the digital role.

Nope. Most wills are silent on digital assets, and even if they aren’t, tech companies’ Terms of Service can override a will unless you’ve given your executor explicit legal authority under a law like RUFADAA.

Even if your state is one of the few that hasn’t adopted it, having your wishes clearly spelled out in a will or power of attorney is still the best thing you can do. It gives your family a clear roadmap and legal standing to negotiate with tech companies.

It’s better than nothing, but it has flaws. The box can only be opened after a court formally appoints an executor, which can take weeks or months. During that time, online bills could go unpaid and other problems could arise. A password manager with emergency access is much more efficient.

Planning for your digital afterlife might feel a little strange, but it’s one of the greatest gifts you can give your family. You’re saving them from a frustrating, high-tech scavenger hunt during an already difficult time. By taking a few simple, smart steps today, you can ensure your digital legacy is handled with care, security, and exactly the way you want.

Important Note (a.k.a. the Fine Print Without the Tiny Print):

We’re talking about digital stuff here, not giving you legal advice. Laws around wills, powers of attorney, and digital assets can be as tricky as trying to reset your Wi-FiWi-Fi, short for Wireless Fidelity, revolutionizes connectivity by enabling devices to access the in... More routerA router is a device that helps connect all your gadgets, like computers, smartphones, and smart hom... More without unplugging the coffee maker by mistake. Before you make any official moves, talk with a qualified estate planning attorney who understands digital assets in your state. They can make sure your plans are legal, airtight, and don’t end up as a high-stakes guessing game for your family later.